Turn your spend into profit.

At Ensure, we understand the importance of managing budgets and preserving revenue, so we built a platform to help you grow your ROI by flipping your Accounts Payable into receivables.

And we’re giving it away.

Enjoy our platform on us. Start Free Today

Partnered with trusted financial institutions.

How we help you

All your expenses in one platform

Ensure offers complete control over what’s being spent, how it’s being spent, and how much is spent. We offer an Integrated Payable Solutions that automates commercial payments, removes friction from your accounts payable, and makes your payments more profitable.

Innovated Financial Regulation

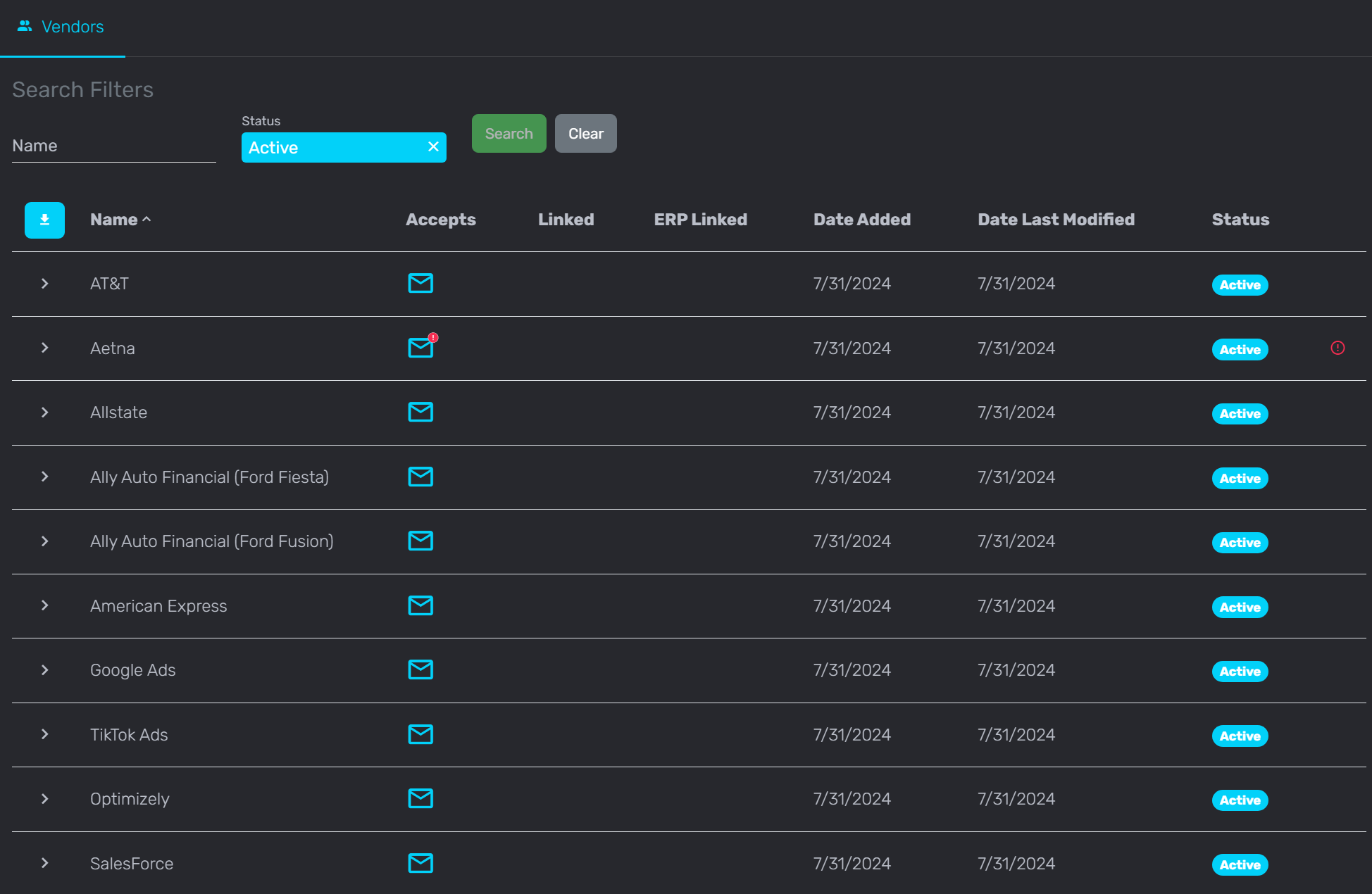

Create governance for

your vendors and costs

Assign custom payments methods directly to employees or vendors and link your existing ERP software with our hassle-free direct integrations.

Dynamic Intelligent Payments

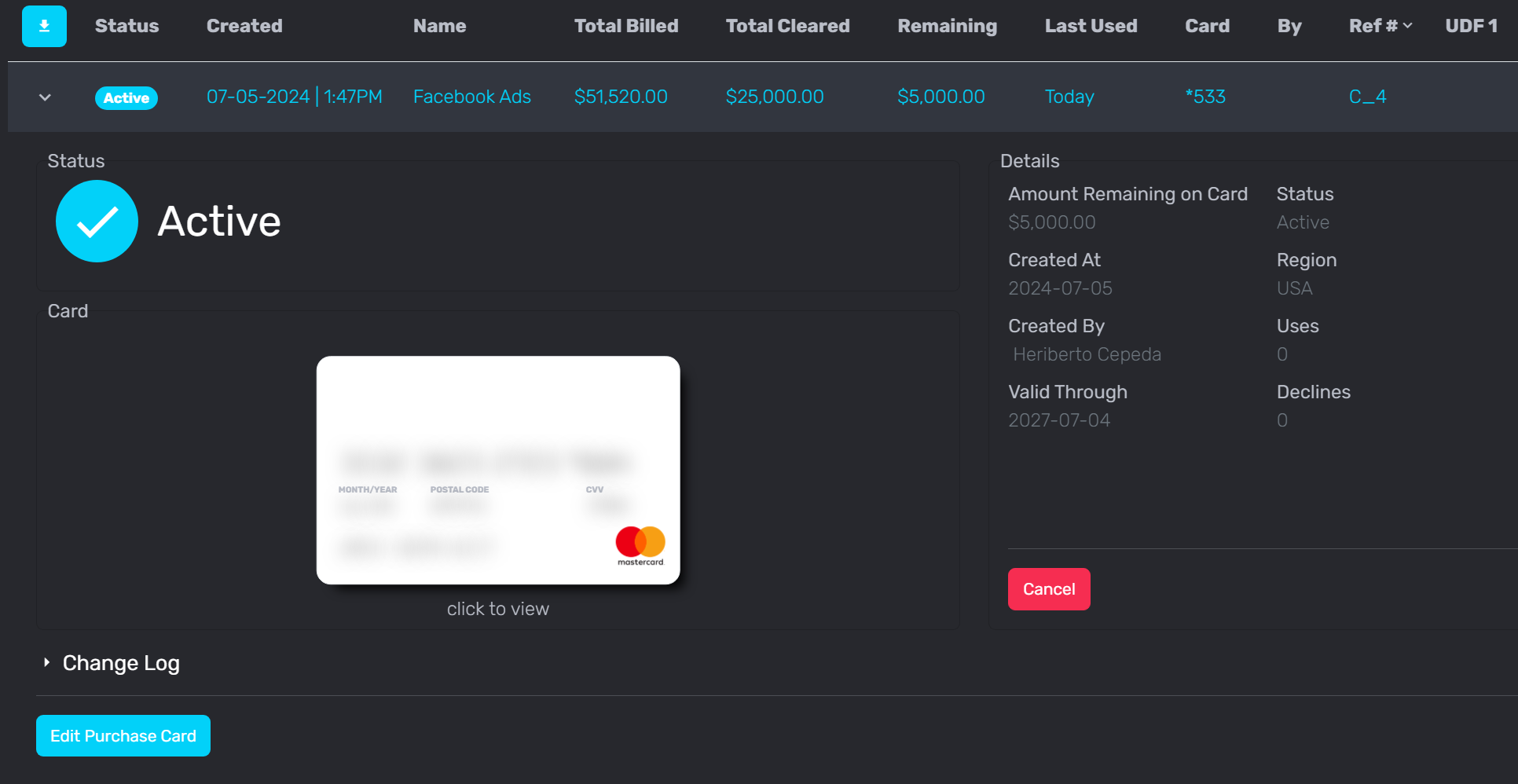

Generate and accept payments

Generate virtual debit cards with dynamic triggers and conditions to automate limits and controls. Intelligent automated payments transmitted in the way that is most profitable for your business, clients and vendors.

Consolidated Reporting

Get informed on your operating performance

All of your expenditures across a limitless number of accounts consolidated into one easy to read report.

Generate cash out of wasted spend

Turn your operating costs and wasted spend into a revenue generator by ensuring your investment starting at dollar one.

Spending management made

easy & accountable

Spend that pays you

A more streamlined and digital payments process means low fees, ensuring improvement to your bottom line.

Fast Transaction Time

Expedite your payable process and approval times, ultimately

saving time and money.

Safe & Secure

Backed by long standing financial institutions, payments can only be processed by the assigned vendor.

Frequently asked questions

What types of payments does Ensure provide?

Ensure provides a variety of payment types, including credit and debit cards, bank transfers, and wires.

How does Ensure work?

Ensure works by providing businesses with a platform to securely process payments. The platform is user-friendly and offers various features, such as reporting tools and automatic invoicing.

How much does Ensure cost to use?

We charge you $0 to use our platform. By using Ensure, you’re guaranteed an ROI for your business.

How does Ensure guarantee an ROI?

Ensure, like other payable solution companies, collects and negotiates fees from merchants. Then we return a portion back to you. We don’t, and will never, sell our customers’ data.

What kind of customer support does Ensure offer?

Ensure offers customer support via email, phone, and chat; with a team of support specialists available to assist with any questions or issues that may arise.

Add Your Heading Text Here

Add Your Heading Text Here

Best In Class Treasury Management

Precision is paramount at Ensure. Our commitment to timely and accurate payment execution sets us apart.

Lorem ipsum dolor

Secure Payment Infrustructure

ISO 20022 New standard to transmit payment data

Lorem ipsum dolor

Leverage All Payment Types

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor